Recent News

02/20/2026

To maximize — or not to maximize — depreciation deductions on your 2025 tax return

The deadlines for filing 2025 tax returns (or extensions) are fast approaching. Although most tax planning moves must be completed by December 31 of the tax year, there are some decisions you can make when filing your return that can save taxes now or in the future. One such decision is whether to claim accelerated depreciation breaks. Depreciation Basics For assets with a useful life of more than one year, the cost generally must be depreciated over a period of years (unless accelerated depreciation breaks are available). In other words, taxpayers can deduct only a portion of the asset’s cost...

Stay up to date! Subscribe to our future blog posts!

10/18/2024

How businesses can better retain their salespeople

The U.S. job market has largely stabilized since the historic disruption of the pandemic and the unusual fluctuations that followed. But the fact remains that employee retention is mission-critical for businesses. Retaining employees is still generally less expensive than finding and hiring new ones. And strong retention is one of the hallmarks of a healthy employer brand. One role that’s been historically challenging to retain is salesperson. In many industries, sales departments have higher turnover rates than other departments. If this has been the case at your company, don’t give up hope. There are ways to address the challenge. Lay...

10/11/2024

Advantages of keeping your business separate from its real estate

Does your business require real estate for its operations? Or do you hold property titled under your business’s name? It might be worth reconsidering this strategy. With long-term tax, liability and estate planning advantages, separating real estate ownership from the business may be a wise choice. How taxes affect a sale Businesses that are formed as C corporations treat real estate assets as they do equipment, inventory and other business assets. Any expenses related to owning the assets appear as ordinary expenses on their income statements and are generally tax deductible in the year they’re incurred. However, when the business sells...

10/04/2024

Understanding your obligations: Does your business need to report employee health coverage?

Employee health coverage is a significant part of many companies’ benefits packages. However, the administrative responsibilities that accompany offering health insurance can be complex. One crucial aspect is understanding the reporting requirements of federal agencies such as the IRS. Does your business have to comply, and if so, what must you do? Here are some answers to questions you may have. What is the number of employees before compliance is required? The Affordable Care Act (ACA), enacted in 2010, introduced several employer responsibilities regarding health coverage. Certain employers with 50 or more full-time employees (called “applicable large employers” or ALEs)...

09/27/2024

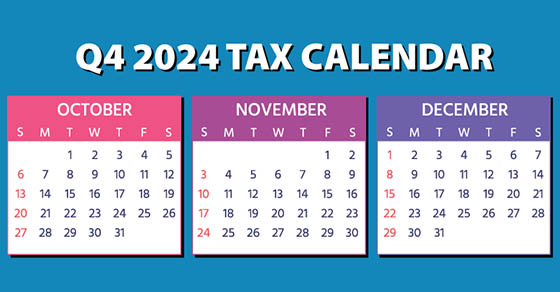

2024 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have a business in a federally declared disaster area. Tuesday, October 1 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t...

09/20/2024

Businesses must stay on guard against invoice fraud

Fraud is a pernicious problem for companies of all shapes and sizes. One broad type of crime that seems to be thriving as of late is invoice fraud. In the second quarter of 2024, accounts payable software provider Medius released the results of a survey of 1,533 senior finance executives in the United States and United Kingdom. Respondents reported that their teams had seen, on average, 13 cases of attempted invoice fraud and nine cases of successful invoice fraud in the preceding 12 months. The average per-incident loss in the United States was $133,000 — which adds up to about $1.2 million...

09/13/2024

It’s time for your small business to think about year-end tax planning

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or next to maximize their tax value. Do you expect to be in a higher tax bracket next year? If so, then opposite strategies may produce better results. For example, you could pull income into 2024 to be taxed at lower rates, and defer deductible expenses...