Recent News

02/02/2026

Consider these issues before providing (or reimbursing) mobile phones

For many employees, mobile phones are no longer a perk — they’re an essential business tool. However, issuing company phones or reimbursing employees for use of their personal devices can create hidden security risks, unexpected tax consequences and productivity concerns for business owners. Here are some key issues to consider before rolling out or revising your company’s mobile phone policy. Security risks In general, the biggest security risk associated with mobile phones is that they may lack robust protections against phishing, malware and other cyberthreats. Hackers could use an employee’s phone to access your business’s IT network, leading to theft...

Stay up to date! Subscribe to our future blog posts!

07/12/2024

Be aware of the tax consequences of selling business property

If you’re selling property used in your trade or business, you should understand the tax implications. There are many complex rules that can potentially apply. To simplify this discussion, let’s assume that the property you want to sell is land or depreciable property used in your business, and has been held by you for more than a year. Note: There are different rules for property held primarily for sale to customers in the ordinary course of business, intellectual property, low-income housing, property that involves farming or livestock, and other types of property. Basic rules Under tax law, your gains and...

07/08/2024

Could a 412(e)(3) retirement plan suit your business?

When companies reach the point where they’re ready to sponsor a qualified retirement plan, the first one that may come to mind is the 401(k). But there are other, lesser-used options that could suit the distinctive needs of some business owners. Case in point: the 412(e)(3) plan. Nuts and bolts Unlike 401(k)s, which are defined contribution plans, 412(e)(3) plans are defined benefit plans. This means they provide fixed benefits under a formula based on factors such as each participant’s compensation, age and years of service. For 2024, the annual benefit provided by 412(e)(3)s can’t exceed the lesser of 100% of a...

06/28/2024

2024 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July 15 Employers should deposit Social Security, Medicare and withheld income taxes for June if the monthly deposit rule applies. They should also deposit nonpayroll withheld income tax for June if the monthly deposit rule applies. July 31 Report income tax withholding and FICA taxes for...

06/21/2024

Hiring your child to work at your business this summer

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages. Benefits for your child There are special tax breaks for hiring your offspring if you operate your business as one of the following: A sole proprietorship, A partnership owned by both spouses, A single-member LLC that’s treated as a sole proprietorship for tax purposes, or An LLC that’s treated as a partnership owned by both spouses. These entities can hire an owner’s under-age-18 children as full-...

06/14/2024

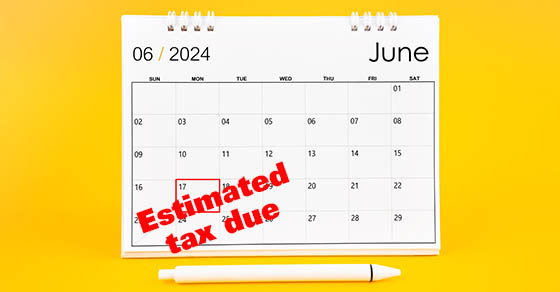

Figuring corporate estimated tax

The next quarterly estimated tax payment deadline is June 17 for individuals and businesses, so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated tax without triggering the penalty for underpayment of estimated tax. Four possible options The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under one of the following four methods: Current year method. Under this option, a corporation can avoid the estimated tax underpayment penalty by paying 25% of the tax...

06/07/2024

Inflation enhances the 2025 amounts for Health Savings Accounts

The IRS recently released guidance providing the 2025 inflation-adjusted amounts for Health Savings Accounts (HSAs). These amounts are adjusted each year, based on inflation, and the adjustments are announced earlier in the year than other inflation-adjusted amounts, which allows employers to get ready for the next year. Fundamentals of HSAs An HSA is a trust created or organized exclusively for the purpose of paying the qualified medical expenses of an account beneficiary. An HSA can only be established for the benefit of an eligible individual who is covered under a high-deductible health plan (HDHP). In addition, a participant can’t be...