Recent News

02/20/2026

To maximize — or not to maximize — depreciation deductions on your 2025 tax return

The deadlines for filing 2025 tax returns (or extensions) are fast approaching. Although most tax planning moves must be completed by December 31 of the tax year, there are some decisions you can make when filing your return that can save taxes now or in the future. One such decision is whether to claim accelerated depreciation breaks. Depreciation Basics For assets with a useful life of more than one year, the cost generally must be depreciated over a period of years (unless accelerated depreciation breaks are available). In other words, taxpayers can deduct only a portion of the asset’s cost...

Stay up to date! Subscribe to our future blog posts!

12/29/2023

The standard business mileage rate will be going up slightly in 2024

The optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up by 1.5 cents per mile in 2024. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 67 cents (up from 65.5 cents for 2023). The increased tax deduction partly reflects the price of gasoline, which is about the same as it was a year ago. On December 21, 2023, the national average price of a gallon of regular gas was $3.12, compared with $3.10 a year earlier, according to...

12/22/2023

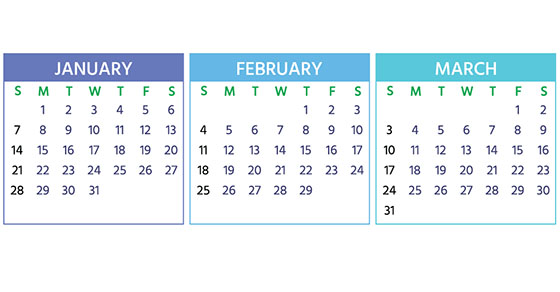

2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines. January 16 (The usual deadline of January 15 is a federal holiday) Pay the final installment of 2023 estimated tax. Farmers and fishermen: Pay estimated tax for 2023. If you don’t pay your estimated tax by January 16, you must file your 2023 return and pay...

12/15/2023

Giving gifts and throwing parties can help show gratitude and provide tax breaks

The holiday season is here. During this festive season, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good time to review the tax rules associated with these expenses. Are they tax deductible by your business and is the value taxable to the recipients? Employee gifts Many businesses want to show their employees appreciation during the holiday time. In general, anything of value that you transfer to an employee is included in his or her taxable income (and, therefore, subject to income and payroll taxes) and deductible...

12/08/2023

Is your business underestimating the value of older workers?

The job market remains relatively tight for businesses looking to fill open positions or simply add top talent when the fit is right. That means it’s still important for companies to continuously reassess where they’re looking for applicants and which job candidates they’re focusing on. In October, global employment nonprofit Generation, in partnership with the Organisation for Economic Co-operation and Development (OECD), released a report entitled The Midcareer Opportunity: Meeting the Challenges of an Ageing Workforce. Its results are based on OECD data along with a survey of thousands of employers, job candidates and employees in the United States and Europe. Among the...

12/01/2023

There still may be time to reduce your small business 2023 tax bill

In the midst of holiday parties and shopping for gifts, don’t forget to consider steps to cut the 2023 tax liability for your business. You still have time to take advantage of a few opportunities. Time deductions and income If your business operates on a cash basis, you can significantly affect your amount of taxable income by accelerating your deductions into 2023 and deferring income into 2024 (assuming you expect to be taxed at the same or a lower rate next year). For example, you could put recurring expenses normally paid early in the year on your credit card before...

11/26/2023

Key 2024 inflation-adjusted tax parameters for small businesses and their owners

The IRS recently announced various inflation-adjusted federal income tax amounts. Here’s a rundown of the amounts that are most likely to affect small businesses and their owners. Rates and brackets If you run your business as a sole proprietorship or pass-through business entity (LLC, partnership or S corporation), the business’s net ordinary income from operations is passed through to you and reported on your personal Form 1040. You then pay the individual federal income tax rates on that income. Here are the 2024 inflation adjusted bracket thresholds. 10% tax bracket: $0 to $11,600 for singles, $0 to $23,200 for married...