Recent News

02/02/2026

Consider these issues before providing (or reimbursing) mobile phones

For many employees, mobile phones are no longer a perk — they’re an essential business tool. However, issuing company phones or reimbursing employees for use of their personal devices can create hidden security risks, unexpected tax consequences and productivity concerns for business owners. Here are some key issues to consider before rolling out or revising your company’s mobile phone policy. Security risks In general, the biggest security risk associated with mobile phones is that they may lack robust protections against phishing, malware and other cyberthreats. Hackers could use an employee’s phone to access your business’s IT network, leading to theft...

Stay up to date! Subscribe to our future blog posts!

11/03/2023

Businesses: Know who your privileged users are … and aren’t

Given the pervasiveness of technology in the business world today, most companies are sitting on treasure troves of sensitive data that could be abducted, exploited, corrupted or destroyed. Of course, there’s the clear and present danger of external parties hacking into your network to do it harm. But there are also internal risks — namely, your “privileged users.” Simply defined, privileged users are people with elevated cybersecurity access to your business’s enterprise systems and sensitive data. They typically include members of the IT department, who need to be able to reach every nook and cranny of your network to install...

10/27/2023

The Social Security wage base for employees and self-employed people is increasing in 2024

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basic details The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed workers — one for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other for Hospital Insurance, which is commonly known as the Medicare tax. There’s a maximum amount of compensation subject to the Social Security tax,...

10/20/2023

Business automobiles: How the tax depreciation rules work

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle. Depreciation is built into the cents-per-mile rate First, be aware that separate depreciation calculations for a passenger auto only come into play if you choose to use the actual expense method to calculate deductions. If, instead, you use the standard mileage rate (65.5 cents per...

10/13/2023

A refresher on the trust fund recovery penalty for business owners and executives

One might assume the term “trust fund recovery penalty” has something to do with estate planning. It’s important for business owners and executives to know better. In point of fact, the trust fund recovery penalty relates to payroll taxes. The IRS uses it to hold accountable “responsible persons” who willfully withhold income and payroll taxes from employees’ wages and fail to remit those taxes to the federal government. A matter of trust The trust fund recovery penalty applies to employees’ share of payroll taxes, including withheld federal income taxes and the employee share of Social Security and Medicare taxes. These...

10/06/2023

What types of expenses can’t be written off by your business?

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general rule is contained in the first sentence of Section 162, which states you can write off “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.” Basic definitions In general, an expense is ordinary if...

09/29/2023

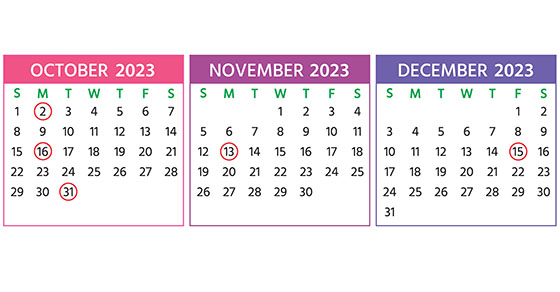

2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 2 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain...