Recent News

02/20/2026

To maximize — or not to maximize — depreciation deductions on your 2025 tax return

The deadlines for filing 2025 tax returns (or extensions) are fast approaching. Although most tax planning moves must be completed by December 31 of the tax year, there are some decisions you can make when filing your return that can save taxes now or in the future. One such decision is whether to claim accelerated depreciation breaks. Depreciation Basics For assets with a useful life of more than one year, the cost generally must be depreciated over a period of years (unless accelerated depreciation breaks are available). In other words, taxpayers can deduct only a portion of the asset’s cost...

Stay up to date! Subscribe to our future blog posts!

09/27/2022

Work Opportunity Tax Credit Provides Help to Employers

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face significant barriers to employment. The credit is worth as much as $2,400 for each eligible employee ($4,800, $5,600 and $9,600 for certain veterans and $9,000 for “long-term family assistance recipients”). It’s generally limited to eligible employees who begin work for the employer before January 1, 2026. The IRS recently issued some updated information on the pre-screening and certification processes. To...

09/21/2022

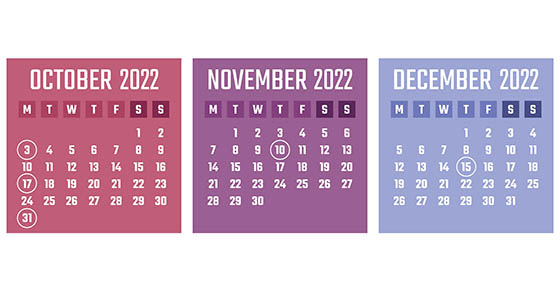

2022 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 3 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain...

09/13/2022

Hey, Watch the Language! (In Your Employee Handbook)

Every company needs an employee handbook to ensure that everyone understands the policies, procedures and rules of the organization. However, an improperly written handbook can inadvertently create a binding obligation that can be used against you. What you don't want is for the documents to be interpreted as an employment contract. Keep this in mind when crafting or revising your employee handbook, so you can lower the risk of legal claims by litigious employees. Here's a list of dos and don'ts: Don't use phrases such as "permanent position" or "the company promises." There should be no statements that you don't intend, or may...

08/30/2022

Inflation Reduction Act Provisions of Interest to Small Businesses

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes. There has been a lot of media coverage about the law’s impact on large corporations. For example, the IRA contains a new 15% alternative minimum tax on large, profitable corporations. And the law adds a 1% excise tax on stock buybacks of more than $1 million by publicly traded U.S. corporations. But there are also provisions that provide tax relief for small businesses. Here are two: A Payroll Tax Credit for Research Under current law, qualified small...

08/23/2022

Key Aspects of a Successful Wellness Program

Wellness programs have found a place in many companies’ health care benefits packages, but it hasn’t been easy. Because these programs take many different shapes and sizes, they can be challenging to design, implement and maintain. There’s also the not-so-small matter of compliance: The federal government regulates wellness programs in various ways, including through the Health Insurance Portability and Accountability Act and the Americans with Disabilities Act. Whether your business is just embarking on the process of creating one or simply looking for improvement tips, here are some key aspects of the most successful wellness programs. Simplicity and Clarity “Welcome...

08/16/2022

How to Treat Business Website Costs for Tax Purposes

These days, most businesses have websites. But surprisingly, the IRS hasn’t issued formal guidance on when website costs can be deducted. Fortunately, established rules that generally apply to the deductibility of business costs provide business taxpayers launching a website with some guidance as to the proper treatment of the costs. Plus, businesses can turn to IRS guidance that applies to software costs. Hardware Versus Software Let’s start with the hardware you may need to operate a website. The costs fall under the standard rules for depreciable equipment. Specifically, once these assets are operating, you can deduct 100% of the cost...