Recent News

02/20/2026

To maximize — or not to maximize — depreciation deductions on your 2025 tax return

The deadlines for filing 2025 tax returns (or extensions) are fast approaching. Although most tax planning moves must be completed by December 31 of the tax year, there are some decisions you can make when filing your return that can save taxes now or in the future. One such decision is whether to claim accelerated depreciation breaks. Depreciation Basics For assets with a useful life of more than one year, the cost generally must be depreciated over a period of years (unless accelerated depreciation breaks are available). In other words, taxpayers can deduct only a portion of the asset’s cost...

Stay up to date! Subscribe to our future blog posts!

04/06/2021

Tax Advantages of Hiring your Child at your Small Business

As a business owner, you should be aware that you can save family income and payroll taxes by putting your child on the payroll. Here are some considerations. Shifting Business Earnings You can turn some of your high-taxed income into tax-free or low-taxed income by shifting some business earnings to a child as wages for services performed. In order for your business to deduct the wages as a business expense, the work done by the child must be legitimate and the child’s salary must be reasonable. For example, suppose you’re a sole proprietor in the 37% tax bracket. You hire...

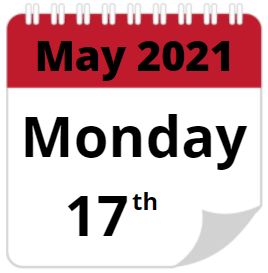

03/25/2021

Federal The Internal Revenue Service (IRS) announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended to May 17, 2021. Pennsylvania The PA Department of Revenue announced that the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns has been extended to May 17, 2021. Estimated Income Tax Payments (Federal & PA) As of March 19, 2021, the IRS and PA Department of Revenue had not granted an extension on estimated payments. The deadline remains April 15, 2021 for taxpayers who make estimated income tax payments.

03/09/2021

Work Opportunity Tax Credit Extended Through 2025

Are you a business owner thinking about hiring? Be aware that a recent law extended a credit for hiring individuals from one or more targeted groups. Employers can qualify for a tax credit known as the Work Opportunity Tax Credit (WOTC) that’s worth as much as $2,400 for each eligible employee ($4,800, $5,600 and $9,600 for certain veterans and $9,000 for “long-term family assistance recipients”). The credit is generally limited to eligible employees who began work for the employer before January 1, 2026. Generally, an employer is eligible for the credit only for qualified wages paid to members of a...

02/22/2021

During the COVID-19 pandemic, many people are working from home. If you’re self-employed and run your business from your home or perform certain functions there, you might be able to claim deductions for home office expenses against your business income. There are two methods for claiming this tax break: the actual expenses method and the simplified method. Who Qualifies? In general, you qualify for home office deductions if part of your home is used “regularly and exclusively” as your principal place of business. If your home isn’t your principal place of business, you may still be able to deduct home...

02/16/2021

Have you received a postcard or letter from…. What is a Decennial Report?A Decennial Report is a report filed with the Commonwealth of Pennsylvania to allow a business to continue exclusive use of its name. When is a Decennial Report due?Decennial Reports are filed every ten years during the years ending with the numeral “1”. Therefore, Decennial Reports are due by December 31, 2021. Who is required to file a Decennial Report?Almost every entity that conducts business in Pennsylvania and wishes to continue exclusive use of its name is required to file unless the entity has made a new or...

01/29/2021

The New Form 1099-NEC and the Revised 1099-MISC Are Due to Recipients Soon

There’s a new IRS form for business taxpayers that pay or receive certain types of nonemployee compensation and it must be furnished to most recipients by February 1, 2021. After sending the forms to recipients, taxpayers must file the forms with the IRS by March 1 (March 31 if filing electronically). The requirement begins with forms for tax year 2020. Payers must complete Form 1099-NEC, “Nonemployee Compensation,” to report any payment of $600 or more to a recipient. February 1 is also the deadline for furnishing Form 1099-MISC, “Miscellaneous Income,” to report certain other payments to recipients. If your business...