PA Decennial Report

February 16, 2021

Have you received a postcard or letter from….

What is a Decennial Report?

A Decennial Report is a report filed with the Commonwealth of Pennsylvania to allow a business to continue exclusive use of its name.

When is a Decennial Report due?

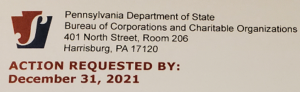

Decennial Reports are filed every ten years during the years ending with the numeral “1”. Therefore, Decennial Reports are due by December 31, 2021.

Who is required to file a Decennial Report?

Almost every entity that conducts business in Pennsylvania and wishes to continue exclusive use of its name is required to file unless the entity has made a new or amended filing with the Bureau of Corporation and Charitable Organizations from January 1, 2012 through December 31, 2021. Therefore, entities formed and registered in Pennsylvania during that time period are not required to file a Decennial Report during 2021.

How is a Decennial Report filed?

The report is filed on Form DSCB 54-503 and requires a $70 filing fee. Acuity Advisors can prepare this report as 2020 business returns are being completed or a business may prepare its own report by accessing the form at www.dos.pa.gov.

A member of your Acuity service team will discuss the preparation of this report as your 2020 business tax returns are being completed. Please contact us if you have any questions regarding this filing requirement.

Similar blogs

Subscribe

Stay up to date! Subscribe to our future blog posts!