Favorable ETRs Follow Boards Active Engagement in Oversight of their Company’s Tax Risk

Posted: July 21, 2020New research finds that boards of directors who play an active role in the risk management of their company’s tax function, and who know which questions to ask and when, are often rewarded with more favorable effective tax rates for the company, lower tax uncertainty, and less risk to their company’s reputation.[i]

BDO Tax Partners Richard Bayer and Daniel Newton recently spoke with one of the study co-authors, Nathan Goldman, assistant professor of accounting at North Carolina State University’s Poole College of Management, to gain greater insight into the findings of the study.

The researchers evaluated proxy disclosures for 665 non-financial, non-regulated U.S. publicly traded companies belonging to the Russell 1000 index to understand the level of each board’s involvement in risk management. The researchers also analyzed the financial reporting for income taxes to better understand the level of tax planning each company undertook.

“Our study would say that they [the board] should be getting more involved,” noted Goldman. He goes on to say that “we estimate that companies with the highest level of risk oversight have 31% lower tax uncertainty and 13.2% lower tax burden, as compared to companies with the lowest level of risk oversight.”

To achieve these results, tax initiatives that companies take would focus more on achieving permanent tax savings, instead of temporary savings that would result in cash tax benefits being paid back in future years. The cash generated from these permanent tax savings can be invested back into the business to spur further growth and expansion opportunities that ultimately should favorably impact a company’s bottom line and investor sentiment.

It’s Execution of the Strategy, Not Just the Strategy

Oftentimes, companies find that a well-designed strategy doesn’t achieve the expected results. In searching for the reason why, all too often poor results come down to poor execution of the strategy. Tax planning is an area where board risk oversight would play a vital role in ensuring the company is pursuing appropriately risk-balanced tax reduction strategies and setting the right tone from the top.

Companies with greater board oversight in taxes are “not doing things that the IRS is going to fight them on for the next four years but rather they’re doing things that are going to logically lower their tax rates in a safe and secure manner,” says Goldman about increased board involvement in understanding the company’s tax profile.

The study notes that more aggressive and risky tax-planning strategies may result in several unanticipated negative consequences for a company, notably increased future cash tax outflows and potential reputational damage. To counter this, Goldman notes that “when you have legitimate operations, not only does it fall into the OECD BEPS implementation plans, it really falls into a logical business process that should be earning a lower tax rate.”

Room for Enhancement – Not All Board Members Are Equal Regarding Taxes

While it is clear from the study that there should be greater involvement by boards of directors in understanding the company’s tax profile and strategy, recent studies conducted by BDO find that not all board members have a clear understanding of their company’s tax strategy.

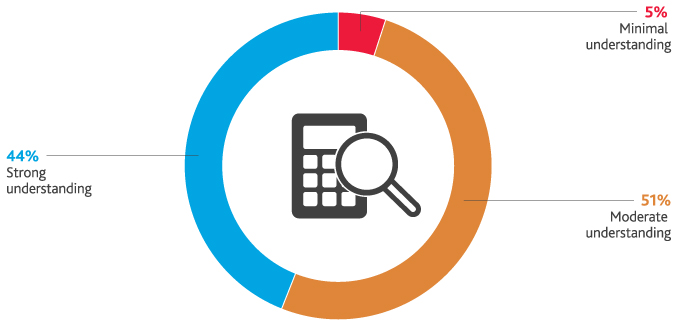

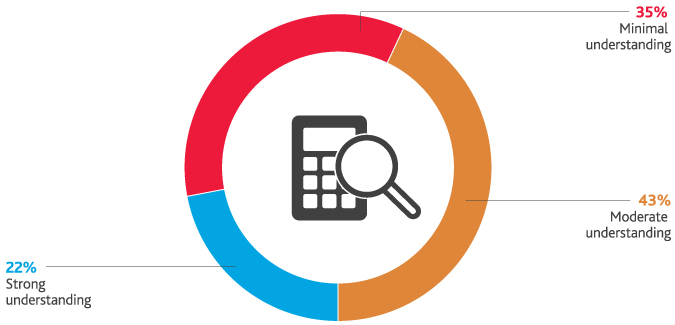

BDO’s Center for Corporate Governance and Financial Reporting conducts a survey of board members each year on various topics that boards are currently facing. In the 2018 and 2019 surveys, board members were asked “What level of understanding do you have of the total tax liability of your business and its impact on your corporate tax strategy?”

The 2018 study showed that 95% of respondents had a strong to moderate understanding of their company’s tax strategy. However, the results for 2019 showed a marked decrease in board members’ understanding of the corporate tax strategy, where only 65% responded that they have a strong or moderate understanding. One factor that could explain the decrease is that the 2018 survey was conducted shortly after tax reform was enacted in the United States. As the Tax Cuts and Jobs Act is the most significant piece of tax legislation to be enacted since the Tax Reform Act of 1986, it would be expected that boards would increase their oversight at that time.

Investing in tax planning and strategy is something that you “can’t think about twice a year, you have to think about it with every major decision,” noted Goldman. If desired outcomes by the boards of directors include increasing shareholder value and appropriately managing tax risk, this supports the assertion that implementing these practices can be worth the time and resource investment.

Taxes – More Than Just Income

While income tax expense can represent one of the largest line-item expenses on a company’s income statement, other non-income-based taxes (i.e. VAT, property, sales and use, payroll, and others) comprise a significant portion of a company’s total tax liability. As tax dynamics continue to grow in complexity, and the digital economy increases transparency, the strategic roles of the board and tax executives becomes more apparent. Examining total tax liability and modeling the various business impacts is necessary for companies to survive and thrive during periods of great change.

Past Practices Don’t Need to Dictate the Future

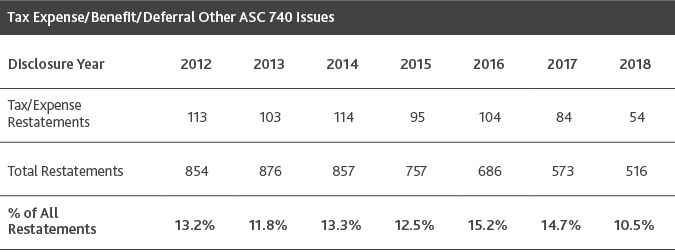

The study notes that boards’ lack of prudent oversight has led to several regulatory changes (e.g., Sarbanes-Oxley Act of 2002’s creation of the PCAOB) in the past couple of decades, specifically focused on strengthening the board’s role in risk oversight. Many tax departments have managed the tax function with little involvement from the board, which has led to financial restatements, material weaknesses and other issues related to financial reporting.

The firm Audit Analytics conducts a review each year of financial restatements and the underlying causes. Their research has found that in six out of the past seven years studied, tax has been one of the top three reasons that companies restate their financials. Their conclusions note that “many of these restatements relate to foreign tax, specialty taxes or planning issues.”

As evidenced by the Audit Analytics review results, it can be surmised that as tax issues continue to be elevated to the board, risk oversight by the board would likely result in more effective tax-planning strategies and lower financial statement risk for the company.

As a Board Member, What Questions Should I Be Asking?

- Resources –

- Does the company have the right resources in place to adequately address all the tax issues and planning opportunities that the company faces?

- How are third-party advisors utilized and integrated into planning initiatives and day-to-day operations?

- Increased Government and Public Scrutiny –

- How is the company and tax function preparing for the upcoming U.S. presidential election and the potential tax and economic uncertainty that may ensue?

- How is the company preparing for and complying with increased global tax reporting requirements (i.e., BEPS, UK tax strategy disclosure, country-by-country reporting)?

- Does the company have the appropriate systems and controls in place to handle its reporting and compliance matters?

- Highly Judgmental Areas –

- How are significant judgements and estimates analyzed and concluded upon that may impact the company’s financial statements and disclosures?

- What is the company’s appetite for risk in tax matters and is that consistent with the company’s overall strategy?

- How does the company assess the likelihood of success on tax positions taken and whether a reserve for uncertain tax positions is necessary?

- Integration with Other Business Leaders –

- How is the tax function aligned with leaders from other parts of the business on strategy execution and growth plans?

- Financial Metrics –

- How does the company assess the success and effectiveness of the tax function?

- GAAP Tax Rate? Non-GAAP Tax Rate? Cash Taxes? Others?

- Board Interaction –

- How often is the tax function invited to present to the board on significant tax matters that the company faces?

CONTACT